Introduction: As of January 1, 2024, the European Directive DACC7 2021/514 has come into effect, mandating platforms or websites facilitating the rental, sale, or purchase of goods or real estate to maintain a record of user transactions and report them to the Tax Agency. This directive aims to ensure users declare their earnings, preventing the evasion of taxes through substantial monetary transactions.

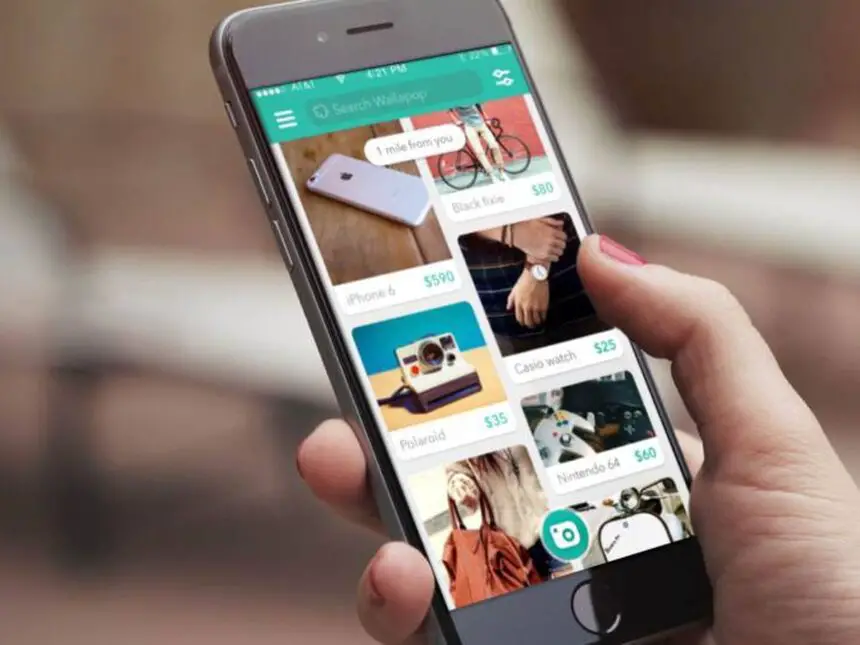

The Evolution of Consumer Habits and the Impact of the Directive: Technological advancements and the recent inflationary crisis in Europe have led to a complete transformation in consumer purchasing habits. Second-hand market applications such as Wallapop or Vinted have witnessed increased popularity, especially among the younger demographic, embracing the buying and selling of pre-owned items to give them a second life.

Since 2022, tax authorities had signaled their intent to scrutinize transactions occurring on second-hand platforms to combat tax evasion, with warnings issued to users. However, the recent directive formalizes the obligation for these platforms to report user earnings, necessitating the provision of personal data, including bank details, transaction counts for the last quarter, and profit details.

Platforms Subject to Reporting and User Obligations: As of now, applications involved in the sale or rental of goods, personal services, transportation, or real estate are obligated to declare user earnings. This involves sharing user data, transaction frequency, and profits with tax authorities. Platforms like Wallapop have communicated to users that they are required to report:

- Users with more than 30 sales in a calendar year, irrespective of the sale amount.

- Annual profits exceeding €2,000 after deducting fees, taxes, and commissions.

In such instances, users will receive notifications through email and notification centers, prompting them to complete the necessary legal information within the next 60 natural days. Failure to comply will result in the suspension of the seller’s profile.

Understanding Tax Liabilities: The directive specifies tax rates based on the user’s annual earnings from selling fashion and tech items. Users with earnings up to €6,000 are subject to a 19% tax rate. Earnings ranging from €6,001 to €50,000 incur a 21% tax rate, while profits exceeding €50,000 are taxed at 23%.

Additionally, if sales through these platforms become a regular activity, and income surpasses the minimum wage, it is considered an economic activity. In such cases, sellers are obligated to register as self-employed and commence Value Added Tax (VAT) declarations.

Conclusion: The implementation of the EU Directive DACC7 2021/514 marks a significant shift in the taxation landscape for users engaging in transactions on platforms like Vinted, Wallapop, and Airbnb. Adherence to reporting requirements and understanding tax implications is crucial to ensure compliance and avoid legal consequences. Stay informed about the latest updates and considerations regarding this directive here and explore a comprehensive guide on tax obligations for platform users here.